mediadjat.ru

News

Can I Open A Roth Ira And A 401k

_to_a_Roth_IRA_Account.png?width=2626&name=Steps_in_Rolling_Over_a_Roth_401(k)_to_a_Roth_IRA_Account.png)

The good news is you don't have to choose between a Roth (k) and a Roth IRA — you can have both. If you receive a Roth (k) through your employer, consider. However, if the (k) funds are pre-tax, then converting to a Roth IRA will be a taxable event. Nevertheless, a conversion has the potential to help reduce. Yes, and you can have a Traditional IRA, a Traditional and Roth , and Traditional b and Roth b and others depending on what industry you work in. If your employer doesn't offer a (k) plan, a Roth IRA is an excellent alternative. You may consider a Roth IRA even if your employer offers a (k) because. Can you contribute to a (k) and Roth IRA? The short answer is yes, but make sure that you understand these rules, regulations, and limitations. You can only use a (k) if you have one at your job. On the other hand, anyone with earned income can open and contribute to an IRA. There are a few other key. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. Yes, you can contribute to both a designated Roth account and a traditional, pre-tax account in the same year in any proportion you choose. Is there a limit on. The quick answer is yes, you can have both a (k) and an individual retirement account (IRA) at the same time. The good news is you don't have to choose between a Roth (k) and a Roth IRA — you can have both. If you receive a Roth (k) through your employer, consider. However, if the (k) funds are pre-tax, then converting to a Roth IRA will be a taxable event. Nevertheless, a conversion has the potential to help reduce. Yes, and you can have a Traditional IRA, a Traditional and Roth , and Traditional b and Roth b and others depending on what industry you work in. If your employer doesn't offer a (k) plan, a Roth IRA is an excellent alternative. You may consider a Roth IRA even if your employer offers a (k) because. Can you contribute to a (k) and Roth IRA? The short answer is yes, but make sure that you understand these rules, regulations, and limitations. You can only use a (k) if you have one at your job. On the other hand, anyone with earned income can open and contribute to an IRA. There are a few other key. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. Yes, you can contribute to both a designated Roth account and a traditional, pre-tax account in the same year in any proportion you choose. Is there a limit on. The quick answer is yes, you can have both a (k) and an individual retirement account (IRA) at the same time.

It doesn't matter if you're covered by an employer's retirement plan, such as a (k) or (b). As long as you don't exceed the IRS's income limits, you can. No income limits: Anyone can contribute to a Roth (k), if available, regardless of income level. In contrast, only individuals earning less than $, in. As long as you have earned income, you can contribute to a Roth IRA.2 Although (k)s (retirement plans through an employer) and IRAs (retirement. A Roth IRA conversion occurs when you take savings from a Traditional, SEP or SIMPLE IRA, or qualified employer-sponsored retirement plan (QRP), such as a Yes, it could make sense to open a Roth IRA at least five years before you plan to rollover your Roth (k). However, it's not enough to open it. Yes, you can open a Roth IRA even if you already have and contribute to a retirement plan at work, such as a (k) or (b). Determining how much to. If your income is not so high as to disqualify you, yes, you should contribute to a Roth IRA (outside of work) in addition to your (k). IRA stands for individual retirement account. · If you're eligible, you can contribute to both a Roth and traditional IRA in the same year—though you can only. Roth IRAs with J.P. Morgan · Our J.P. Morgan Advisors and online investing tools can help you prioritize your long-term investing and retirement goals. · Open. Making Roth contributions to your (k) plan does not reduce the amount you may contribute to a Roth IRA annually (unlike a Roth (k). You are eligible. Finally, a Roth (k) is only available through an employer plan. As long as you meet the above MAGI income requirements, you can open a Roth IRA on your own. However, you should use Form to report amounts that you converted from a traditional IRA, a SEP, or Simple IRA to a Roth IRA. Return to Top. Distributions. Contributions to a Roth are never deductible For instance, if you are covered by a retirement plan at work: You can deduct up to the contribution limit. No income limits: Anyone can contribute to a Roth (k), if available, regardless of income level. In contrast, only individuals earning less than $, in. It doesn't matter if you're covered by an employer's retirement plan, such as a (k) or (b). As long as you don't exceed the IRS's income limits, you can. Roth IRAs are not subject to required minimum distribution (RMD) rules during the lifetime of the original owner, so you can leave your assets in the Roth IRA. Can I roll my (k) into an IRA? Yes. If you have assets in a (k) with an employer that you no longer work for, you can roll over these assets. You can. How can I convert to a Roth IRA? For a Traditional IRA at Bank of America or Merrill, we will help you open a Roth IRA and fill out the conversion form. It is possible to have a (k) and an IRA, and contributing to both could help grow your retirement savings. But there are rules involved. Learn more. This is when you roll over or "convert" funds from non-Roth accounts, such as traditional IRAs, (b)s, and (k)s, into a new Roth IRA. You pay taxes when.

Places To Sell My Plasma Near Me

DO NOT SELL OR SHARE MY INFORMATION. Colmar, PA. North Line Street Colmar, PA ; Phone: M-Th: 7 AM-3 PM. F: AM to AM. A woman donating plasma as the phlebotomist checks the plasma collection bag. Unlike a whole blood donation, where you give whole blood with all three blood. Plasma donation changes lives, one donor at a time. · New Plasma Donors Can Earn Over $ During the First 35 Days! · New Plasma Donors Can Earn Over $ During. But with PlasmaSource, there are more benefits of donating plasma. Every plasma donation earns you cash. So, you get paid while doing something good for others. Plasma Donations Thank you for your interest in donating plasma. The Central California Blood Blood Donation Locator · Business Portal · Blood Donation. The donation compensation helps me support my kids and buy miscellaneous supplies for the house. Joel C. The reason I donate plasma is because of a near-. Talecris Grifols on stark is my first and only spot. Their staff is good and their new donate sign on bonus is like in 4 visits. After that. 36 votes, 73 comments. There's a new center near me that accepts and pays for plasma donations. I'm considering it. Find your nearest Grifols Plasma donation center, where you can get paid, donate plasma, & save lives. Start your rewarding journey today! DO NOT SELL OR SHARE MY INFORMATION. Colmar, PA. North Line Street Colmar, PA ; Phone: M-Th: 7 AM-3 PM. F: AM to AM. A woman donating plasma as the phlebotomist checks the plasma collection bag. Unlike a whole blood donation, where you give whole blood with all three blood. Plasma donation changes lives, one donor at a time. · New Plasma Donors Can Earn Over $ During the First 35 Days! · New Plasma Donors Can Earn Over $ During. But with PlasmaSource, there are more benefits of donating plasma. Every plasma donation earns you cash. So, you get paid while doing something good for others. Plasma Donations Thank you for your interest in donating plasma. The Central California Blood Blood Donation Locator · Business Portal · Blood Donation. The donation compensation helps me support my kids and buy miscellaneous supplies for the house. Joel C. The reason I donate plasma is because of a near-. Talecris Grifols on stark is my first and only spot. Their staff is good and their new donate sign on bonus is like in 4 visits. After that. 36 votes, 73 comments. There's a new center near me that accepts and pays for plasma donations. I'm considering it. Find your nearest Grifols Plasma donation center, where you can get paid, donate plasma, & save lives. Start your rewarding journey today!

Donate · Donate Blood · Health history questionnaire · Update an appointment · Donation Types · Locations · Learn · Impact of donation · Blood types. Back to Locations Kentucky. PaducahPlasma Donation Center. Now Open. Mon - Fri: am - pm; Sat: am - pm. James Sanders Blvd. Depending on how often you donate, you can earn as much as $ per month donating plasma at Hermanus. Add that extra cash towards your groceries, retirement. al Find a Blood Drive Near You ar 02After Robert recovered from COVID, he switched from giving blood to donating lifesaving COVID Convalescent Plasma . Click the link below to find a plasma donation center near you. Then, make an appointment to save lives today. Find a Place Near You · Plasma Protein. Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. New Donor Bonus. New donors can get up to $ in their first month donating. Learn More. Find your center. KEDPLASMA has over 70 donation centers across the country. Find out which one is closest to you and the services and plans it offers. Enter your phone number and ZIP Code and get matched to your nearest plasma donation center faster than you buy your morning coffee. Download Now. We Serve. KEDPLASMA US specializes in the collection and procurement of high-quality plasma that is processed into plasma-based therapies. I'M INTERESTED IN DONATING. New. The need for plasma and plasma donors is more urgent than ever before. Visit mediadjat.ru to learn more and to find a donation center near you. Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. Make your blood donation go further by donating blood plasma. A single AB The Red Cross is working with hospitals around the clock to meet the. I was afraid of needles before, but the money was a good enough incentive for me to give donating plasma a try,” Rasure says. plasma around then because “. Make a difference by donating plasma at ABO Plasma Collection Centers. Donating plasma can save lives—join us today and be rewarded for your contribution! Your plasma donation could be the difference for someone fighting to stay alive. Where can I donate plasma for money near me? ] You can donate plasma at any. Last time I spent two hours 45 minutes donating plasma and platelets: they gave me Netflix to watch. Blood & Plasma Donation Centers Near Me. Apple Valley, MN. As a Biomat USA plasma donor, your comfort and safety is our number one priority. While every donor is compensated and rewarded for donating plasma, the real. Enter your phone number and ZIP Code and get matched to your nearest plasma donation center faster than you buy your morning coffee. Download Now. We Serve. Considering making your first plasma donation? It's natural to have questions like: “Where can I find a plasma donation center near me?”, “What's involved in.

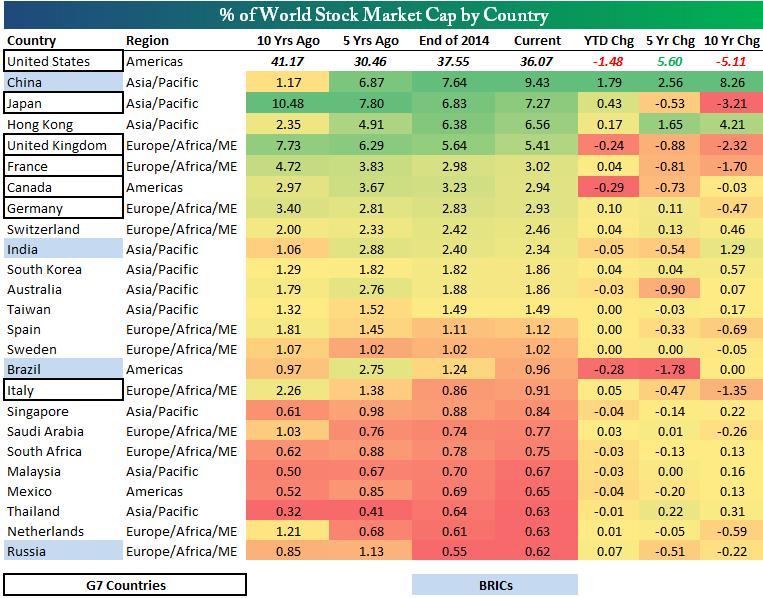

Stock Market Ranking

Welcome to our list of public companies ranked by their market capitalization, specifically those with a market cap exceeding $10 million and traded on the US. Today there are 2, companies listed on the Australian Stock Exchange · 1. ASX:CBA · Commonwealth Bank, B · 2. ASX:BHP · BHP Group Limited, B · 3. A list of all stocks listed on the NASDAQ, NYSE and NYSE American in the United States, sorted by market cap and updated daily. In total, Fortune companies represent two-thirds of the U.S. GDP with $ trillion in revenues, $ trillion in profits, and $43 trillion in market value. Cash Equity Market (TSE) · TOPIX2, · JPX Prime Index1, · JPX-Nikkei , · Growth Market Index · REIT Index. Stock market capitalization, billion USD, ; USA, , 1 ; China, , 2 ; Japan, , 3 ; Hong Kong, , 4. The Largest Companies by Market Cap in · 1. Apple · 2. Microsoft · 3. Nvidia · 4. Alphabet (Google) · 5. Amazon · 6. Saudi Arabian Oil · 7. Meta Platforms · 8. Get the latest stock market news, including real-time stock quotes & indexes. The experts at Fidelity offer investing insights & analysis to help you invest. In the United States, the S&P , the Dow Jones Industrial Average, and the Nasdaq Composite are the three most followed indexes by the media and investors. Welcome to our list of public companies ranked by their market capitalization, specifically those with a market cap exceeding $10 million and traded on the US. Today there are 2, companies listed on the Australian Stock Exchange · 1. ASX:CBA · Commonwealth Bank, B · 2. ASX:BHP · BHP Group Limited, B · 3. A list of all stocks listed on the NASDAQ, NYSE and NYSE American in the United States, sorted by market cap and updated daily. In total, Fortune companies represent two-thirds of the U.S. GDP with $ trillion in revenues, $ trillion in profits, and $43 trillion in market value. Cash Equity Market (TSE) · TOPIX2, · JPX Prime Index1, · JPX-Nikkei , · Growth Market Index · REIT Index. Stock market capitalization, billion USD, ; USA, , 1 ; China, , 2 ; Japan, , 3 ; Hong Kong, , 4. The Largest Companies by Market Cap in · 1. Apple · 2. Microsoft · 3. Nvidia · 4. Alphabet (Google) · 5. Amazon · 6. Saudi Arabian Oil · 7. Meta Platforms · 8. Get the latest stock market news, including real-time stock quotes & indexes. The experts at Fidelity offer investing insights & analysis to help you invest. In the United States, the S&P , the Dow Jones Industrial Average, and the Nasdaq Composite are the three most followed indexes by the media and investors.

According to statistics of the World Federation of Exchanges (WFE), as of the end of November, , the Exchange ranked 3rd, 5th and 1st respectively in terms. US Top Companies by Market Cap: Get the Top Companies by Market capitalization in US with stocks performance, technical chart, historical data & more. Stocktwits provides real-time stock, crypto & international market data to keep you up-to-date. Find top news headlines, discover your next trade idea. Latest Sector News ; Updated 10 minutes ago Stock Rotation Hits Megacaps as Apple Sinks 3%: Markets Wrap ; Updated 21 minutes ago Titanic Shipyard Owner Set to. The Stock Exchange of Hong Kong is the third-largest stock exchange in Asia, and the fifth largest in the world with a market capitalisation of $ trillion. Market Watch. Index Charts Listed Stock Yield Rate Ranking Statistics Market Cap of Listed Co. market data from the Taiwan Stock Exchange. Copyright. Stocks are often categorized by market cap: mega-cap ($ billion plus), large-cap ($10 billion-$ billion), mid-cap ($2 billion-$10 billion), small-cap ($. TSX30 is the flagship program recognizing the 30 top-performing companies on Toronto Stock Exchange (TSX). Eligible listed issuers are ranked based on their. Helsinki Stock Exchange tops sustainability disclosure ranking while most flatlined. The world's largest companies are under-reporting sustainability policies. Countries ranked by Market Cap ; 1, United States, $ T ; 2, China, $ T ; 3, Japan, $ T ; 4, India, $ T. Microsoft, Nvidia, and Apple are the top three global companies by that measure, each with market caps of over $3 trillion. Technology companies rank among the. Other Statistics · Ranking of Stocks by Market Capitalization · Data & Statistics · Listed Companies · Equities, Debt, Funds · Derivatives · Rules & Trading. 58, Listed companies ; North America. DOW JONES. Mexico IPC ; Europe. AEX. AEX All Shares ; Asia, Pacific. ASX BIST ; South America. Caracas. Ibovespa. Top Ranking ; Top 10 Value · EA. , + (+%), 4,, ; Top 10 Volume · EA. , + (+%), ,, ; Top 10 Gainers · CV. , + (+. The New York Stock Exchange is the largest stock market in the world. It currently has a market cap of $ trillion. Frequently Asked Questions. The U.S. market ranks each of the ten S&P sectors for the selected time period (Today, 5-Day, 1-Month, 3-Month, 6-Month, Year-to-Date, 1-Year, 5-Year, and Zacks #1 Rank Additions. Ranks best stock industry groups and SIC codes by the average weighted alpha of the stocks contained within the group. Use Nasdaq's stock screener to find stocks that meet your investment criteria. Filter by industry, market cap, P/E ratio, and other financial metrics.

Real Estate Fees Selling House

The commission fee typically ranges from 5% to 6% of your home's sale price and is split between the listing and buying agents, as well as their respective. The real estate agent's commission, which is split between the seller's agent and buyer's agent — is usually the biggest fee a seller pays — 5 to 6 percent of. In my most recent transaction, % of the final sale price. In my case, that was about $ The commission was split between my realtor (the. When closing on a home, there are costs associated with the sale. Home Rocket Mortgage, LLC, Rocket Homes Real Estate LLC, and RockLoans. To calculate the proceeds from your home sale, you'll need to subtract the real estate agent fees, your outstanding mortgage balance, closing costs, and any. Depends on the location of the property. Some counties and cities charge a transfer tax and some don't. The rate can vary from 0 to as much as 2% of the sale. On average, real estate commissions run 5% to 6% of a home's sale price, with the money typically split equally between the seller's and buyer's agents. On a. For example, a seller who wishes to add an incentive to buyers' agents to show the property might pay his agent % of the sales price, but offer the buyer's. Table of Contents The average cost to sell a California home is about % of the total sale price. Based on the average home value of $,, that works. The commission fee typically ranges from 5% to 6% of your home's sale price and is split between the listing and buying agents, as well as their respective. The real estate agent's commission, which is split between the seller's agent and buyer's agent — is usually the biggest fee a seller pays — 5 to 6 percent of. In my most recent transaction, % of the final sale price. In my case, that was about $ The commission was split between my realtor (the. When closing on a home, there are costs associated with the sale. Home Rocket Mortgage, LLC, Rocket Homes Real Estate LLC, and RockLoans. To calculate the proceeds from your home sale, you'll need to subtract the real estate agent fees, your outstanding mortgage balance, closing costs, and any. Depends on the location of the property. Some counties and cities charge a transfer tax and some don't. The rate can vary from 0 to as much as 2% of the sale. On average, real estate commissions run 5% to 6% of a home's sale price, with the money typically split equally between the seller's and buyer's agents. On a. For example, a seller who wishes to add an incentive to buyers' agents to show the property might pay his agent % of the sales price, but offer the buyer's. Table of Contents The average cost to sell a California home is about % of the total sale price. Based on the average home value of $,, that works.

Sellers usually pay both their listing agent's commission and the buyer agent's commission charges, generally % of the home sale price per agent. Agent. The average sale price of a house in Georgia is now $,, according to the Georgia Association of Realtors. That translates to an average commission payout. Types of Selling Expenses That Can Be Deducted From Home Sale Profit · advertising · appraisal fees · attorney fees · closing fees · document preparation fees. Real estate transactions that involve rental activity, leasing or property management are NOT real estate brokerage services that require a real estate license. Let's say, for example, that a buyer and seller (each with a real estate agent) agree to a deal on a home for $, Assuming the real estate commission is 5. Real estate agents don't receive an upfront payment from the seller of a home they represent. Instead, they receive a percentage of the sales price in the. In Texas, commissions for real estate sales tend to average around %. Learn more about how much you could make as a real estate agent by using our. Answer: The commission is typically 7% on the first $, of the sale price and % on the balance, though individual realtors may have different rates. Sellers can expect to pay around 6–10% of the home's purchase price (including real estate agent commissions). So, if you're selling a house, don't think you're. It is not. There is no requirement from the state that instructs the seller to pay the buyer's agent's commission. Then why do we do it? For California Realtors®, the average is 6 percent of the total sale price of the property. Most full-service agents calculate the cost as a percentage of the. Real estate agent fees In a traditional home sale, the seller pays fees to both their agent and the buyer's agent. It's common for the total commission to. The average realtor fee for selling a house is six percent of the sale price. So, if you sell your house for $,, the realtor will make. Sellers often pay 2–4% of the sale price on these fees, not including real estate agent commissions. Factor those in and total closing costs can be more like 8–. Sellers can expect to pay 2% to 4% of the sale price of the home in fees and taxes on top of the agent commission. Based on the national median home sale price. However, listing your house as “for sale by owner” (FSBO) means you won't need to pay extra commission to a real estate agent — 6% of the selling price is. To calculate the proceeds from your home sale, you'll need to subtract the real estate agent fees, your outstanding mortgage balance, closing costs, and any. The same concept still applies to the sale of Massachusetts real estate. At the time of the sale of a home, the seller is required to be a tax to the. Real Estate Agent Commission These fees can vary. When you sell with Redfin you pay a % listing fee, half the fee other brokerage often charge. Buyer's.

Biggest Impact Funds

.png)

Active Impact Investments is Canad'a largest climate tech seed fund. Located in Vancouver, BC, we provide money and talent to accelerate the growth of. BlackRock's flagship social impact investment platform, enabling clients to invest in direct private market opportunities that accelerate positive economic. The Global Impact Investing Network (GIIN) is the global champion of impact investing, dedicated to increasing its scale and effectiveness around the world. The Fellowship is a highly competitive summer program placing top-performing graduate students at ICM member funds, with the objective of advancing. investment and financing due to economic disadvantage. One of the biggest challenges is the gap between pre-seed and seed funding for these early-stage. The Impact Fund is built on Palatine's long heritage in sustainable investing. biggest challenges we face as a society. These themes are aligned to the. GIIN membership represents the largest global community of impact investors (asset owners and asset managers) and service providers engaged in impact investing. The deputy CEO of BlueOrchard Finance and impact head at Schroders Capital shares her vision for impact investing and where she sees the greatest opportunities. The Rise Fund The Rise Funds were founded in by TPG in partnership with Bono and Jeff Skoll with the goal of putting commercial capital to work toward. Active Impact Investments is Canad'a largest climate tech seed fund. Located in Vancouver, BC, we provide money and talent to accelerate the growth of. BlackRock's flagship social impact investment platform, enabling clients to invest in direct private market opportunities that accelerate positive economic. The Global Impact Investing Network (GIIN) is the global champion of impact investing, dedicated to increasing its scale and effectiveness around the world. The Fellowship is a highly competitive summer program placing top-performing graduate students at ICM member funds, with the objective of advancing. investment and financing due to economic disadvantage. One of the biggest challenges is the gap between pre-seed and seed funding for these early-stage. The Impact Fund is built on Palatine's long heritage in sustainable investing. biggest challenges we face as a society. These themes are aligned to the. GIIN membership represents the largest global community of impact investors (asset owners and asset managers) and service providers engaged in impact investing. The deputy CEO of BlueOrchard Finance and impact head at Schroders Capital shares her vision for impact investing and where she sees the greatest opportunities. The Rise Fund The Rise Funds were founded in by TPG in partnership with Bono and Jeff Skoll with the goal of putting commercial capital to work toward.

Global impact investing database with top financial-first impact funds, portfolio companies and fund managers to power your impact investments. Book demo! The Gates Foundation. One of the most well-known impact investment funds is the Bill & Melinda Gates Foundation, launched by the celebrated Windows pioneer with. investment to help solve the most difficult problems the public cares about. Sign up to receive the latest social impact investment news and insights from. Impact investing is the act of purposefully making investments that help achieve certain social and environmental benefits while generating financial. The ImpactAssets 50 (IA 50) is the most recognized free database of impact investment fund managers committed to generating positive impact. Learn More! Why invest in climate tech. The biggest challenges are also the biggest investment opportunities. The world is replacing every brick of the fossil economy. The most active private investors in blended finance have included Ceniarth LLC, Calvert Impact Capital, Standard Chartered Bank (StanChart), Société Générale . A record impact fund managers were included totalling $ billion in assets, invested across a range of asset classes and impact themes. Award-winning impact investing news, delivered straight to your inbox. Stay ahead of the curve on impact investing and sustainable finance. Calvert Impact channels investments to high impact organizations that you won't find in the S&P From renewable energy funds providing affordable solar. The Impact Fund is built on Palatine's long heritage in sustainable investing. After many years of being one of the leading houses in ESG, we decided to raise. Capria Fund, LLC (Capria Ventures) ; CASPIAN SME IMPACT FUND IV (Caspian Impact Investment Adviser) ; China Energy Efficiency Partners (Sustainable Development. Calvert Impact channels investments to high impact organizations that you won't find in the S&P From renewable energy funds providing affordable solar. Global impact investing database with top financial-first impact funds, portfolio companies and fund managers to power your impact investments. Book demo! The Rise Fund The Rise Funds were founded in by TPG in partnership with Bono and Jeff Skoll with the goal of putting commercial capital to work toward. Eklavya Growth and Impact Fund 1 (Eklavya Growth and Impact Fund1), Middle Africa · Private Equity / Venture Capital ; Energy Access Ventures Fund (Energy Access. These funds invest in companies solving the world's biggest challenges—climate change, resource scarcity, equality, health, housing, and more. Today, the impact investing market is estimated to be worth $ trillion, according to GIIN, and the vast majority of impact investors receive the returns. impact investments on behalf of its impact funds. The firm has two Zeal Capital Partners is a venture capital fund seeking to generate top-tier. The Fund will invest through intermediary impact funds as a “fund of funds funding to where it can have the biggest impact and provide a good return.

Top 5 Tax Relief Companies

Choose the Most Trusted Tax Relief Company Precision Tax Relief has a 98% satisfaction rating in over reviews—more than any other tax relief agency. We. Best Overall: Precision Tax Relief · Best Guarantee: Anthem Tax Services · Best for Large Tax Debt: Fortress Tax Relief · Best for Small Tax Debt: CommunityTax. Discover top-rated tax relief companies, learn how to resolve back taxes and unravel effective tax relief strategies for a financially sound future. Polston Tax Resolution & Accounting is a full-service tax & accounting firm specializing in IRS tax help, accounting, advanced tax preparation & planning. Discover top-rated tax relief companies, learn how to resolve back taxes and unravel effective tax relief strategies for a financially sound future. The Top 5 Ways to Pay IRS Tax Debt in Full Tax Defense Network is a well-established tax resolution company that specializes in finding affordable solutions. Optima Tax Relief. Overall Score · 2, User Reviews ; Tax Defense Network. Overall Score · 2, User Reviews ; Anthem Tax Services. Overall Score. Priority Tax Relief Has Been Solving Tax Issues with 20 Years of Expertise - A+ Rated BBB Service You Can Rely On! Most tax resolution companies use the same business model as far as I'm aware but I only have personal experience with OTR. I will check in over. Choose the Most Trusted Tax Relief Company Precision Tax Relief has a 98% satisfaction rating in over reviews—more than any other tax relief agency. We. Best Overall: Precision Tax Relief · Best Guarantee: Anthem Tax Services · Best for Large Tax Debt: Fortress Tax Relief · Best for Small Tax Debt: CommunityTax. Discover top-rated tax relief companies, learn how to resolve back taxes and unravel effective tax relief strategies for a financially sound future. Polston Tax Resolution & Accounting is a full-service tax & accounting firm specializing in IRS tax help, accounting, advanced tax preparation & planning. Discover top-rated tax relief companies, learn how to resolve back taxes and unravel effective tax relief strategies for a financially sound future. The Top 5 Ways to Pay IRS Tax Debt in Full Tax Defense Network is a well-established tax resolution company that specializes in finding affordable solutions. Optima Tax Relief. Overall Score · 2, User Reviews ; Tax Defense Network. Overall Score · 2, User Reviews ; Anthem Tax Services. Overall Score. Priority Tax Relief Has Been Solving Tax Issues with 20 Years of Expertise - A+ Rated BBB Service You Can Rely On! Most tax resolution companies use the same business model as far as I'm aware but I only have personal experience with OTR. I will check in over.

Our Promise as Tax Debt Relief Professionals. Our goal is to always provide the highest level of IRS assistance. We are proud that our clients refer their. With an A+ rating, Direct Tax Relief is a company that helps individuals and businesses resolve tax debt problems with IRS tax relief programs. Best for affordability: Community Tax · Best for customer service: Precision Tax Relief · Best for in-person assistance: Tax Defense Network · Best for freelancers. Review of the 4 best tax relief companies · Anthem Tax Services · Larson Tax Relief · Community Tax · Precision Tax Relief. Review of the 4 best tax relief companies · Anthem Tax Services · Larson Tax Relief · Community Tax · Precision Tax Relief. Optima Tax Relief. Overall Score · 2, User Reviews ; Tax Defense Network. Overall Score · 2, User Reviews ; Anthem Tax Services. Overall Score. Top 10 Best Tax Relief Near Irvine, California ; 1. Jeff Huang, CPA · (32 reviews). Accountants · Payroll Services · Tax Services. mi ; 2. Bharmal and. If you have been trying to get tax debt relief you're in luck, we have reviewed & compared the best tax relief companies for What to Look for in a Tax Relief Company · 1. Clean Background · 2. No Scams · 3. Transparent Process · 4. Realistic Results · 5. Knowledge of Reputable Programs. A couple of well recommended ones are The Tax Hardship Center and Larson Tax Relief. With exemplary consumer reviews and a results-oriented process, Tax Hardship Center stands as a solid choice if you're seeking back tax assistance. If you owe. Anthem Tax Services: The Best Guarantee in the Industry With Anthem Tax Services, you can rest easy knowing that you're in good hands. Their. 35 ILCS /(49); 35 ILCS /(36); 35 ILCS /(35); 35 ILCS /(44). Real Estate Transfer Tax – Individuals, Title Companies and Settlement. Alleviate Tax provides tax relief services that can substantially reduce your tax liability, possibly saving you tens of thousands in penalties, interest, and. At Ideal Tax, we offer a Fresh Start Program that can help you get relief from your IRS tax debt. We have over 1 years of experience and an A+ BBB rating. The best everyone else can hope for is an extension of time to pay off their tax debts, which typically will include additional interest and penalties. What Is. IRS Tax Debt Settlement Companies in Milwaukee. Desire To Settle IRS Tax Debt For Less Than You Owe? Our Tax Lawyers Use 5 Powerful Tax Strategies Almost No. Company Description: Optima Tax Relief is the leading nationwide tax resolution firm list of fastest-growing companies 5 years in a row, with a 3. CENTRAL VALLEY FOOD SERVICES INC. DBA JACK-IN-THE-BOX, HERNDON AVE CLOVIS, CA , 11/12/, $ 3,, Best debt settlement companies. Accredited Debt Relief: Best for fast debt payoff. National Debt Relief: Best for customer satisfaction. New Era Debt Solutions.

Staff Travel Emirates

At the airport, you can expect a smooth check-in experience guided by our friendly airport staff. Emirates Skywards members or those traveling in First Class or. Emirates Airbus A travel. Stewardess dress. Flight attendant portrait. Emirates airline travel. IFE system. Economy class seats. Dubai, UAE - NOVEMBER Click here to generate a new RPIN. For browser IT related issues, write to [email protected] For Staff Travel queries, write to [email protected] Across the world every day, Emirates' flights connect people and businesses, enabling travel, tourism and trade. Two dnata operations staff in hi-vis standing. Emirates staff get bonus of nine weeks' pay. Saturday, 11 May, 0 Intrepid Travel is a world leader in sustainable experience-rich travel that. Check schedules, embargoes and make standby listings on BA flights. Applicable to holders of other airlines' rebate travel tickets, not already listed on a BA. Tried emailing them as per the id given on staff traveler app/website, however, no luck in getting a response. Anyone tried non rev with. For all airline professionals who cherish the joy of travel. Experience the unique perks of airline staff travel with American Airlines, Delta Air Lines. Emirates requires all Standby passengers to have a listing prior to departure. · - Staff passengers whose tickets have been issued by EK ( document) via. At the airport, you can expect a smooth check-in experience guided by our friendly airport staff. Emirates Skywards members or those traveling in First Class or. Emirates Airbus A travel. Stewardess dress. Flight attendant portrait. Emirates airline travel. IFE system. Economy class seats. Dubai, UAE - NOVEMBER Click here to generate a new RPIN. For browser IT related issues, write to [email protected] For Staff Travel queries, write to [email protected] Across the world every day, Emirates' flights connect people and businesses, enabling travel, tourism and trade. Two dnata operations staff in hi-vis standing. Emirates staff get bonus of nine weeks' pay. Saturday, 11 May, 0 Intrepid Travel is a world leader in sustainable experience-rich travel that. Check schedules, embargoes and make standby listings on BA flights. Applicable to holders of other airlines' rebate travel tickets, not already listed on a BA. Tried emailing them as per the id given on staff traveler app/website, however, no luck in getting a response. Anyone tried non rev with. For all airline professionals who cherish the joy of travel. Experience the unique perks of airline staff travel with American Airlines, Delta Air Lines. Emirates requires all Standby passengers to have a listing prior to departure. · - Staff passengers whose tickets have been issued by EK ( document) via.

Staff travel, non-rev, ID90, ZED — these unique benefits of airline staff United Arab Emirates · Zimbabwe. Asia Pacific. See All. Australia · Cambodia. Qantas staff travel information for your next non-rev flight. Provided by the StaffTraveler community. Notes on: general, baggage, dress code, listing. Concessional Travel: Staff travel benefits on Emirates Airline can be availed as per the Staff Travel. Manual. Staff travel benefits on other airlines can be. You don't need to become a member and there is no fee. ∼ Book directly with the hotel ∼ Interline rates - Non-rev travel - ID90 - Travel Industry Rates -. A family friend works for Emirates and reached out about family discount that is almost 50% off. What are the main gotchas for these? You will be eligible for staff travel benefits, including waitlisted and confirmed tickets, from the day you join. How much leave will I be entitled to? United Arab Emirates IHG Careers Explore Hotels IHG Global Brands Hotel Development Travel Professionals Affiliate Programme IHG Agent Need help? learn more about United Arab Emirates ~ Dubai. 43 Hotels featured in United Arab Emirates. Travel · Emirates ID90 multi-segment booking rules (standby / subload / staff tickets) · Ask Question. Asked 8 months ago. Modified 8 months ago. "Emirates airline staff to share in Dh billion profits bonus". The ^ "Emirates Business Class cabin features | Cabin Features | Your journey starts here". Emirates requires all Standby passengers to have a listing prior to departure. · - Staff passengers whose tickets have been issued by EK ( document) via. Our key employee focus areas. Come and grow with us. As a member of our Multi-channel travel agency in the UAE, KSA, Bahrain, Oman, Afghanistan. Your International World. Inspire Your Dreams. BIG Hotel Discounts ONLY for Travel Industry Employees & Their Families. We have now. Staff Travel Voyage Exclusively for Travel Industry Employees, Worldwide Offices - see Contact Us on our website. likes · 47 talking about. This document provides a summary of Etihad Airways' staff travel policies. It outlines the global application of the policies and that local legislation will. Staff travel, Great Incentives, Great Management. Travel Consultant - Travel Professional The Emirates Group Employee Review. Staff Airlines (SA) can help you to check flight loads more than world's airlines for easy and make your standby travel more comfortable and relax. #travelwithteena #purser #cabincrew #flightattendant #aviation #crewlife #cabincrewlife #crew #stewardess #travel #airhostess #aviationlovers #pramugari #pilot. For all airline professionals who cherish the joy of travel. Experience the unique perks of airline staff travel with American Airlines, Delta Air Lines. Staff Travel's unmissable travel offers for Emirates Group employees, created by our team of travel experts, who work around the globe and around the clock.

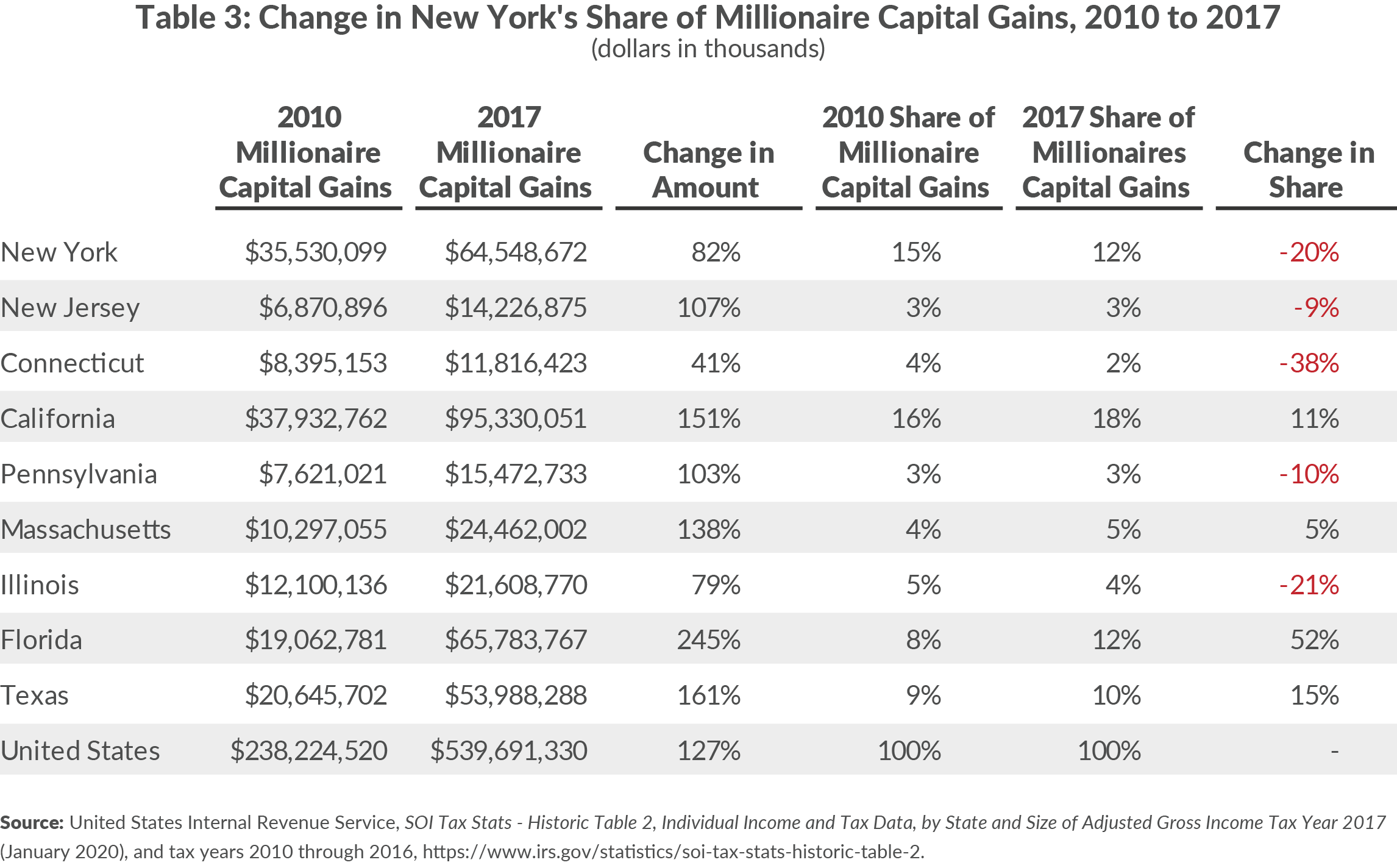

How Much Is Income Tax In New York

Personal Income Tax & Non-resident NYC Employee Payments New York City residents must pay a personal income tax, which is administered and collected by the. If you are married and filing a joint federal income tax return but one spouse is a New York State resident and the other is a nonresident or part-year resident. Not over $14, % of NYC taxable income ; Over $14, but not over $30, $ plus % of excess over $14, ; Over $30, but not over $60, NYPL neighborhood branches across the city will be hosting organizations who can help you prepare and file your tax return electronically—all for free. New York State and local income taxes if your primary residence is within New York State. In addition to being taxable at the member's normal tax rate, if you. Our plan allows you to save on taxes while you save for higher education. Pay no income tax on earnings. The money in your Direct Plan account grows deferred. The City Sales Tax rate is %, NY State Sales and use tax is 4% and the New York State Department of Taxation and Finance. This certificate gives. The top end for personal state taxes in New York was recently raised from % to %. Corporation Franchise Tax. Most small businesses are not traditional C. New York City income tax rates are %, %, % and % depending on your tax bracket and filing status. Remember that NYC income tax is in. Personal Income Tax & Non-resident NYC Employee Payments New York City residents must pay a personal income tax, which is administered and collected by the. If you are married and filing a joint federal income tax return but one spouse is a New York State resident and the other is a nonresident or part-year resident. Not over $14, % of NYC taxable income ; Over $14, but not over $30, $ plus % of excess over $14, ; Over $30, but not over $60, NYPL neighborhood branches across the city will be hosting organizations who can help you prepare and file your tax return electronically—all for free. New York State and local income taxes if your primary residence is within New York State. In addition to being taxable at the member's normal tax rate, if you. Our plan allows you to save on taxes while you save for higher education. Pay no income tax on earnings. The money in your Direct Plan account grows deferred. The City Sales Tax rate is %, NY State Sales and use tax is 4% and the New York State Department of Taxation and Finance. This certificate gives. The top end for personal state taxes in New York was recently raised from % to %. Corporation Franchise Tax. Most small businesses are not traditional C. New York City income tax rates are %, %, % and % depending on your tax bracket and filing status. Remember that NYC income tax is in.

New York has a graduated state individual income tax, with rates ranging from percent to percent.

How much is $k after taxes in NYC? In New York City, $, amounts to about $72, after taxes. Paycheck Calculators by State. With the exception of some qualified New York manufacturers to which a flat percent rate applies, corporations in New York are generally only taxed at a. Yes, the flat 37% rate applies even if an employee claims exemption in their federal Form W-4 from federal income tax withholding. More New York Resources. New. View printable documents for different types of tax rates in our county. Purchases above $ are subject to a % NYC sales tax and a 4% NY State sales tax. Most personal property (for example, alcohol, furniture, electronics, etc). With the exception of some qualified New York manufacturers to which a flat percent rate applies, corporations in New York are generally only taxed at a. For illustrative purposes only. Tax rates used at $K income level for married filing jointly: 35% Federal income tax rate, % Net Investment Income Tax . NYS Pension Taxation Requirements By State Will Your NYS Pension be Taxed If You Move to Another State? If you are considering moving to another state. You are required to file a federal income tax return. · Your federal adjusted gross income plus New York additions was more than $4, ($3, if you are single. New York has nine marginal tax brackets, ranging from 4% (the lowest New York tax bracket) to % for Tax Year Tax Rate. Filing Status. Income Range. The New York (NY) state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as %. NY tax rates vary between 4% and %, depending on your filing status and adjusted gross income. Learn more using the tables below. New York adjusted gross income in prior taxable years in accordance with rate of tax that applies to the related member as effectively reduced by. 2. How much do I owe in self employment tax to the government? The New York self-employment tax is calculated in two sections. First, a set amount is. New York state tax: Income taxes New York has fairly high income tax rates, and New York City's are even higher, ranging from an additional % to %. STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner-occupied, primary residences. The County sales tax is collected by the State of New York. The current sales tax is % which is distributed as follows. New York has a state income tax. The rate individuals pay starts at 4% and tops out at % based on income. LLCs taxed as pass-through entities need to pay. Our plan allows you to save on taxes while you save for higher education. Pay no income tax on earnings. The money in your Direct Plan account grows deferred.

Key Bank Home Equity Rates

Enjoy the benefits of being a KeyBank client. We offer checking & savings accounts, credit cards, insurance, and loans. Open your KeyBank account today! Got % for 30 year with 10% down. Purchase price was million. Went through Keybank. No PMI, probably slight increase in interest rate. Interest rate range: % to %. Besides being subject to change over time, interest rates depend on the size of the line of credit, the borrower's location. Open a Tiered Long-Term CD with $10, – $99, or a High-Yield Jumbo CD with $, – $, Earn the Relationship Reward rate shown when you. KeyBank can help you attain them with a home equity loan. Our loans let you borrow against the equity in your home with a fixed rate and term. To get started, speak to a dedicated Loan Officer at for available home lending products offered. Who can apply for a KeyBank mortgage? You'll build equity fast with a year loan and pay off the home in only 15 years. Compared to a year loan, the interest rate is typically lower – which. Get a rate discount with monthly AutoPay from your Laurel Road or KeyBank Checking. Simplified Home Lending. Online mortgage lending on your terms. Buying a. Is KeyBank HELOC right for you? Discover its key features and pros & cons before you decide. Enjoy the benefits of being a KeyBank client. We offer checking & savings accounts, credit cards, insurance, and loans. Open your KeyBank account today! Got % for 30 year with 10% down. Purchase price was million. Went through Keybank. No PMI, probably slight increase in interest rate. Interest rate range: % to %. Besides being subject to change over time, interest rates depend on the size of the line of credit, the borrower's location. Open a Tiered Long-Term CD with $10, – $99, or a High-Yield Jumbo CD with $, – $, Earn the Relationship Reward rate shown when you. KeyBank can help you attain them with a home equity loan. Our loans let you borrow against the equity in your home with a fixed rate and term. To get started, speak to a dedicated Loan Officer at for available home lending products offered. Who can apply for a KeyBank mortgage? You'll build equity fast with a year loan and pay off the home in only 15 years. Compared to a year loan, the interest rate is typically lower – which. Get a rate discount with monthly AutoPay from your Laurel Road or KeyBank Checking. Simplified Home Lending. Online mortgage lending on your terms. Buying a. Is KeyBank HELOC right for you? Discover its key features and pros & cons before you decide.

rate home equity loan for homeowners to affordably maintain and improve their older houses. The low interest loan product is financed through Key Bank and. Home Equity Loans & Lines of Credit Lenders in Shelton ; KeyBank - Syracuse. Last Updated: 08/27/ NMLS ID: % APR, % Rate ; Union Savings. Actual rates, fees, and terms are based on those Mortgage and Home Equity Lending products offered by KeyBank are not FDIC insured or guaranteed. Online platforms like KeyBank While HELOCs offer adjustable access to funds with variable interest rates, home equity loans provide a fixed sum with stable. This basic loan calculator will give you an idea what your monthly payments may be. Change your monthly payment, loan amount, interest rate or term to see the. A big advantage of a home equity loan is that you get a fixed interest rate for the entire term of the loan. The fixed rate combined with a set deadline to pay. Review of Bank of America home equity loan and HELOC products. Learn about rates, required credit scores and how to apply. A forbearance is an agreement to temporarily pause or reduce your loan payments to allow time to get your finances back on track to pay off the past-due. For a large planned expense or paying off higher-rate loans · Competitive fixed and variable interest rate options · Variable rates as low as % APR1 for We researched Keybank's home equity loan and HELOC to help you figure out How to Convert a HELOC to a Fixed-Rate Loan. Many HELOCs have variable. To receive relationship benefits on a new KeyBank personal loan, which provides a % interest rate discount, you must have owned a Relationship Account at. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; For fixed-rate mortgages and home equity loans, the % interest rate reduction will be reflected in the interest rate on the Promissory Note. For. The % interest rate reduction may not be combined with certain other discounts or promotions and may not be available for all home lending products. Other. Current Mortgage Rates · Homebuying Process · Mortgage Refinancing · Mortgage Mortgage and Home Equity Loans · Auto, Boat & RV Loans · Credit Cards and Lines. A forbearance is an agreement to temporarily pause or reduce your loan payments to allow time to get your finances back on track to pay off the past-due. Home Equity Loans: The Lump Sum Approach Fixed Interest Rates: Offering stability, Home Equity Loans provide predictability with fixed. Online platforms like KeyBank While HELOCs offer adjustable access to funds with variable interest rates, home equity loans provide a fixed sum with stable. KeyBank is Member FDIC. mediadjat.ru is a federally registered service mark of Rates may vary between a minimum of % APR and a maximum of % APR. home lending products, including mortgage, home equity loans and home equity lines of credit, are This Interest rate reduction is available on new KeyBank.

7 Weeks To Lose Weight

That said, many factors influence your ability to lose weight, and it's better to aim for slower and more sustainable weight loss of –2 lbs per week. How can. weeks of gradual build-up. This may also apply to some military At 7 years, 25 percent of the dieters were maintaining a weight loss of Seven weeks provides an optimal period to instil new habits. Research suggests that it takes approximately 21 days to form a habit. Alternate day fastingTrusted Source (ADF): Fast every other day and eat a typical diet on non-fasting days. · The Diet: Fast on 2 out of every 7 days. · The. Our 7-week fitness program is a research-based and time-efficient way to boost your health, and it fits both those who hate and those who love exercise. Most women lose around 13 pounds (6 kg) right after childbirth, which includes the baby's weight, as well as the weight of the amniotic fluid and placenta. When. 25 lbs down! 7 weeks into my journey and I'm loving it! LOOK HOW FAT MY FACE WAS LMAOO. In the first trimester, it's common to lose weight as the result of morning sickness. The nausea can diminish your appetite, and the vomiting can cause you to. Dieticians advise that if you eat calories less than your daily requirement you will lose about 1lb every seven days (expect some variation from person to. That said, many factors influence your ability to lose weight, and it's better to aim for slower and more sustainable weight loss of –2 lbs per week. How can. weeks of gradual build-up. This may also apply to some military At 7 years, 25 percent of the dieters were maintaining a weight loss of Seven weeks provides an optimal period to instil new habits. Research suggests that it takes approximately 21 days to form a habit. Alternate day fastingTrusted Source (ADF): Fast every other day and eat a typical diet on non-fasting days. · The Diet: Fast on 2 out of every 7 days. · The. Our 7-week fitness program is a research-based and time-efficient way to boost your health, and it fits both those who hate and those who love exercise. Most women lose around 13 pounds (6 kg) right after childbirth, which includes the baby's weight, as well as the weight of the amniotic fluid and placenta. When. 25 lbs down! 7 weeks into my journey and I'm loving it! LOOK HOW FAT MY FACE WAS LMAOO. In the first trimester, it's common to lose weight as the result of morning sickness. The nausea can diminish your appetite, and the vomiting can cause you to. Dieticians advise that if you eat calories less than your daily requirement you will lose about 1lb every seven days (expect some variation from person to.

Most women lose around 13 pounds (6 kg) right after childbirth, which includes the baby's weight, as well as the weight of the amniotic fluid and placenta. When. So how much weight do you lose after giving birth? “Most women lose about 10 to 15 pounds right away, due to the baby, placenta and water weight,” says Cynthia. In terms of weight loss, patients in one large trial saw just less than 1% body weight loss per week in the first four weeks, which translates to about 1kg per. Weight Lifting and cardio will ramp up your metabolism, burn more calories and build the body up while doing so. Losing lbs a week is the way it should be. Losing 20 pounds in 7 weeks requires a combination of dietary changes, regular exercise, and lifestyle adjustments. Focus on creating a calorie. Guidelines suggest that you spread out this exercise during the course of a week. For even greater health benefit and to assist with weight loss or maintaining. And don't forget to include moderate to high intensity strength training twice a week. Muscle mass helps your body burn more calories when it's at rest. “Diet. In just 49 days, Jacqui decreased her body fat percentage by %; she increased her lean body mass by three pounds (GAINED muscle while losing fat at the same. Our 7-week fitness program is a research-based and time-efficient way to boost your health, and it fits both those who hate and those who love exercise. It is recommended that you wait at least weeks postpartum to start to lose weight, as your body needs this time to recover from childbirth and establish a. Yes, it's possible to lose 10 pounds in 7 weeks through a combination of a calorie deficit, regular exercise, and a balanced diet. Focus on. Download the free NHS Weight Loss Plan to help you start healthier eating habits, be more active, and start losing weight. The plan is broken down into 12 weeks. Keeping the Weight Off · Walk miles a day, days a week. · Sign up for a yoga, aerobic, or spinning class to ensure an hour of exercise times a week. Week 7. Week 8. Week You can find more advice to help you on your weight management journey in our food and nutrition section. How to lose weight safely. 7 7 7 8 8 8 9 9 9 10 10 10 Simply replacing unhealthy foods with healthy ones—not for a few weeks, but forever—will help. Fitbit Dietitian Tracy Morris developed this kickstart one-week meal plan to help her clients see results, fast. Disclaimers: Please don't try to lose more than. My face really changed after losing 95+ pounds, and now my family is telling me that I look like a totally different person. Eat the right foods. Part of losing weight is gaining muscle for strength and balance. But you need the energy to do so and to continue exercising. Reducing. You need to bring about some major changes in your diet and exercise regularly to shed off a few pounds in a week. Ideally, one should aim to lose a pound per. week so it can make a difference to your weight loss plans. Rather If you would like more guidance on reducing portion sizes to help you lose weight.